The North American International Auto Show, the annual automotive gala in Detroit, may be best known as a stage for manufacturers to display their latest rolling gargantuans. But to judge from this year’s show, the next big thing may be small. Driven in part by the recession, shifting consumer tastes and global marketing strategies, the U.S. manufacturers who once obsessed over trucks and muscle cars are casting a spotlight on their diminutives.

The show opens this week. Chevrolet plans to display its new Cruze and Aveo as well as the tiny Spark. Ford will highlight its Focus and new-to-the-United States Fiesta. Chrysler will put up a Fiat 500. And the Japanese automakers, who entered the small-car fray earlier and more forcefully, will show off the new Mazda 2 and Honda CR-Z and the most recent hybrids.

“It was cool for a while to be in a monster vehicle. Now it’s uncool,” said John DeCicco, a University of Michigan lecturer and longtime auto industry observer. “The Big Three were in denial. But I think they get it now.” Shifting sales figures reflect the new emphasis. Over the past eight years, the market share of compacts and subcompacts has grown from 15% to 23%, according to figures from Edmunds.com Dealers and other said they see a move across the spectrum to smaller vehicles of all types. “We’ve definitely seen a shift from large SUVs to smaller SUVs, and those who looked at larger cars are now looking at mid-size cars,” said Alex Perdikis, executive vice president of Jim Koons Automotive.

“With the shift in the economy, people are looking to be more economical in more facets of their life.” Industry analysts attributed the change to a number of disparate forces. The recession has forced many consumers to reconsider their spending habits. The taste for miniaturization is seeping from consumer electronics into the auto showroom. The quality of small cars, once maligned as “econoboxes,” has improved. With the memory of soaring gas prices so recent, consumers have developed a preference for fuel efficiency. And finally, manufacturers seeking to operate globally are eager to bring some of their models that have proved popular overseas to the U.S. market.

In the same way that an iPod Nano is considered more elegant than a boom box, “things that are large and clumsy are considered out of date and unsophisticated these days,” said Sheryl Connelly, Ford’s manager for global trends. Ford sales have shifted dramatically as a result. In 2004, Ford sales were 70% trucks and SUVs and 30% cars. In 2009, they were 60% cars, the company said.

“There is a shift, definitely a shift toward small cars — not a stampede,” said Jack Fitzgerald, who sells Buick, GMC and Subaru products at his Fitzgerald Auto Mall in Bethesda, Md.

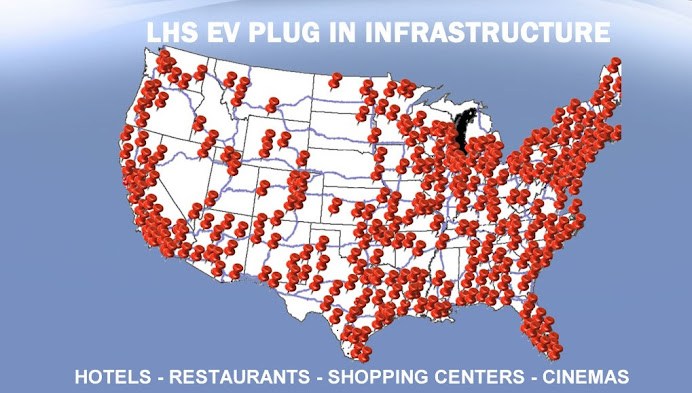

One big display is a 37,000-square-foot “Electric Avenue” on the main floor, featuring 20 vehicles that run on kilowatts instead of gasoline. Electrics were shown last year, but shared the spotlight with cars powered by conventional engines. Much of the show’s buzz is expected to come from electric vehicles, which have jumped off the drawing board and onto the convention floor. Several big automakers plan to sell them in late 2010, giving the broader public its first chance to buy cars that rely more on electrical outlets than gas pumps. The big draw is the chance to stop burning gas and drive a more environmentally friendly car, but the cars are expensive.

Nissan Motor Co.’s rechargeable Leaf, due in showrooms late this year, will make its first appearance inside a U.S. auto show. The Leaf is purely electric, using just a rechargeable battery for power. But its expected cost is about $30,000. Chevrolet’s Volt, unveiled three years ago and for sale this fall, will make a reappearance at the show. It costs about $40,000, although there are up to $7,500 in tax credits available. “Last year we had that ’sky-is-falling’ mentality, and everybody was running for cover,” says Doug Fox, an Ann Arbor, Mich., car dealer and chairman of this year’s show, officially called the North American International Auto Show. “We are seeing a little more investment made in the actual exhibits than last year.” Although auto sales improved at the end of 2009, the 41 new vehicles to be unveiled at this year’s show will be down from last year’s 50, Fox says.

Source : The Washington Post, January 11th, 2010

A study came out today saying that electric cars–both battery electric and plug-in hybrids–would make up as much as 16% of new car sales inNew York City come 2015. That’s roughly 70,000 vehicles.

A study came out today saying that electric cars–both battery electric and plug-in hybrids–would make up as much as 16% of new car sales inNew York City come 2015. That’s roughly 70,000 vehicles.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)